County Magazine | February 13, 2023

The 2024-25 State Budget – Budget writers working on first drafts

The state budget provides counties with limited funding for indigent defense, indigent health care, programs diverting people experiencing a mental health or substance abuse crisis from county jails, and other services. Many of these services are unfunded and underfunded mandates: requirements placed on counties by the state that result in the expenditure of county property taxes to pay for required services.

Texas House and Senate budget writers just filed their introduced budget bills, House Bill 1 and Senate Bill 1. These baseline funding bills, as the introduced bills are known, serve as the starting point for the Legislature’s budget deliberations.

For this budget cycle, there is an unprecedented amount of funding available to spend. The funds are in three pots:

A projected $32.7 billion in general revenue funds – the state’s equivalent of a county general fund – as of Aug. 31, 2023, the end of the current two-year budget.

$3 billion in unspent federal money from the State and Local Coronavirus Fiscal Recovery Fund authorized by the American Rescue Plan Act (ARPA).

$13.7 billion in the state Economic Stabilization Fund (or “rainy day fund”) at the end of the current budget, not accounting for outstanding spending authority and investment earnings or additional appropriations out of the fund.

Comptroller Glen Hegar estimates that the rainy day fund balance will nearly double -- reaching $27.1 billion by Aug. 31, 2025, the end of the upcoming two-year budget, absent any appropriations by the 88th Legislature.

Counties faced similar issues when deciding how to spend their ARPA allocations. Many Texas counties chose to provide large outlays for water and sewer improvements and connections, facilities and capital equipment for law enforcement and firefighters, broadband connectivity and other one-time projects. The challenge for the Legislature is to avoid a fiscal cliff by using this one-time surplus to fund recurring spending that cannot be sustained in future budgets – for example, a large-scale property tax relief package.

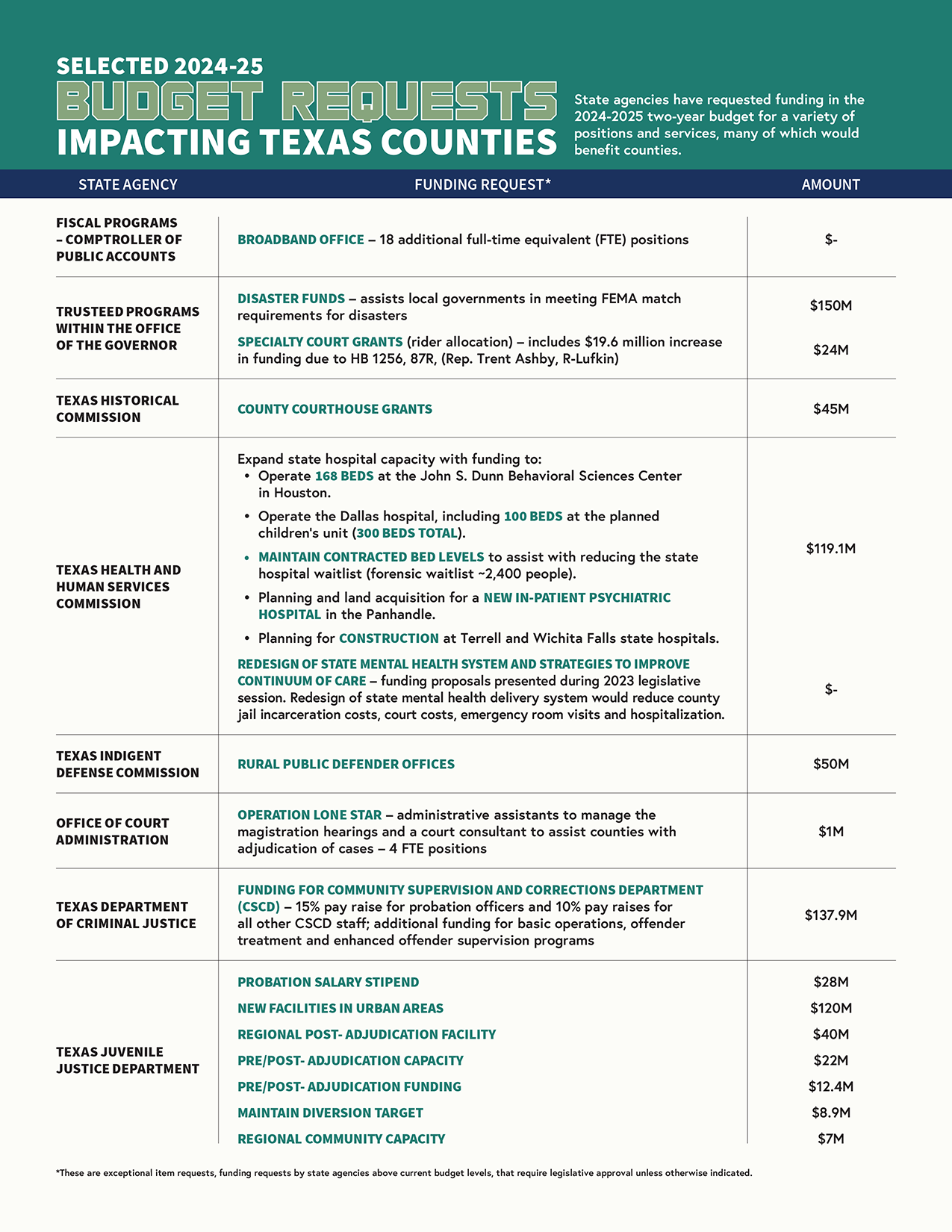

With the state experiencing a windfall in available revenue, counties might expect additional cost-sharing from the state for unfunded and underfunded mandates. Budget requests from state agencies that partner with counties to provide indigent defense, jail diversion and mental health services, and community supervision for adult and juvenile offenders do include increases in county funding (see Chart 1 for selected funding requests that benefit Texas counties).

Reducing the cost of unfunded and underfunded mandates on Texas counties is unlikely to be a state budget priority for the 88th Legislature. However, property tax relief will be a priority, especially for state leaders. Lt. Gov. Dan Patrick, a key member of the state leadership triumvirate, recently proposed an increase in the homestead exemption from $40,000 to as much as $65,000.

Patrick also proposed establishing a rural law enforcement fund for Texas counties. This proposal was inspired by his tour of rural Texas communities and discussions with county judges and sheriffs. Patrick also supports construction of a state mental health hospital in the Texas Panhandle and investing

in the electric grid. Speaker Dade Phelan (R-Beaumont), now in his second session as leader of the House, also supports investing in the grid and the state’s road, water and broadband infrastructure.

Budget spending limits for 2024-25

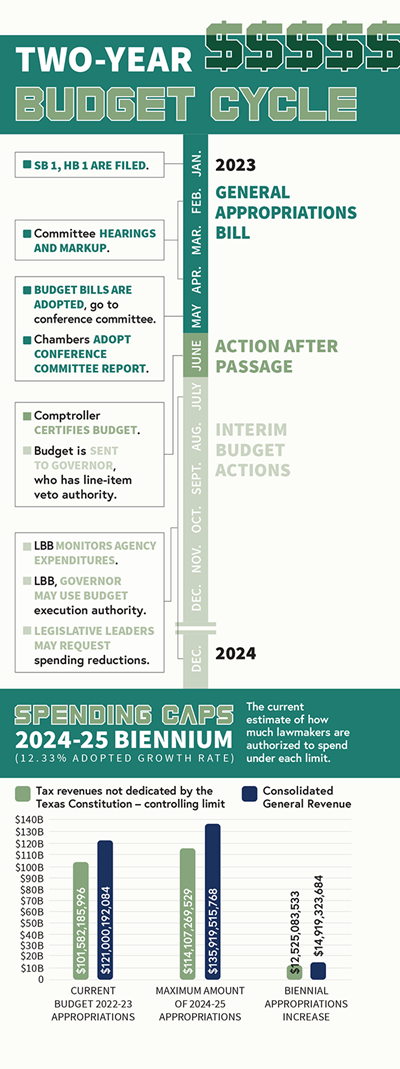

On Nov. 30, the Texas Legislative Budget Board (LBB), a panel of legislators led by Patrick and Phelan, adopted a growth rate of 12.33% for each of the following Texas spending limits.

The state’s Tax Spending Limit restricts increases in appropriations from tax revenue not dedicated by the Texas Constitution to growth in the state economy. The Legislature can exceed this limit with a simple majority vote in both chambers.

The Consolidated General Revenue Appropriations (CGR) Limit, a new limit established by Senate Bill 1336 by Sen. Kelly Hancock (R-North Richland Hills) that is being applied for the first time to the 2024-25 appropriations. The CGR limits growth in appropriations from general revenue-related funds to the estimated compounded growth in population and inflation during the current and upcoming fiscal biennium. The CGR limit applies to a greater proportion of appropriations than the Tax Spending Limit but does not apply to appropriations for property tax relief or for the recovery costs of a disaster declared by the governor. The latter provision would exempt state expenditures for border security from the limit. To exceed the CGR limit, a supermajority vote of three-fifths of each chamber is required.

Applying the adopted growth rate to the Tax Spending Limit allows for a $12.5 billion appropriations increase from nondedicated tax revenue above the current two-year budget. The CGR limit provides for an even greater appropriations increase in general revenue funds subject to the new limit of $15 billion above 2022-23 budgeted amounts. When comparing spending limits, the limit providing the lower spending cap is the controlling limit. Accordingly, the Tax Spending Limit is the controlling limit now that the Legislature has convened. State lawmakers may vote to exceed this limit during the session. Also, the $114.1 billion spending cap will increase when lawmakers enact a supplemental appropriations bill for the current 2022-23 budget.

Neither of these initial estimates of spending capacity allows lawmakers to fully expend the $32.7 billion surplus Comptroller Glenn Hegar projects for the end of the 2022-23 biennium – leaving as much as $20.2 billion of the surplus unspent.

|

For more on the state budget process and its effect on counties, follow the process in TAC’s County Issues newsletter; visit www.county.org/News/County-Issues. Also, check out the state budget webpage on the TAC website and contact your legislative consultant.

|